Financing two cars can be a daunting task, especially when you don’t know where to start. But with the right information and resources, you can make the process much smoother. Two cars mean double the expenses, but also double the convenience.

Whether you’re buying a second car for a spouse or teenager, or simply need a backup vehicle, there are various options available to you. From car loans to leasing, it’s important to weigh the pros and cons of each before deciding on a financing method. Additionally, keep in mind that factors such as credit score and income will affect your eligibility for financing.

So, let’s explore some tips and tricks to help you finance two cars without breaking the bank.

Overview

If you’re wondering if you can finance two cars at once, the answer is yes. But it all depends on your credit score, income, and debt-to-income ratio. Lenders will use these factors to determine if you’re a good candidate for financing two vehicles.

It’s important to keep in mind that financing two cars can increase your monthly expenses significantly. You’ll need to be able to make both payments on time to avoid damaging your credit score. Additionally, you’ll need to factor in the cost of insurance, maintenance, and repairs, which can also add up quickly.

Be sure to do your research and shop around for the best rates and terms before making any decisions.

Explanation on how to finance two cars at once

Financing two cars at once can seem daunting, but it’s definitely doable with the right approach. It’s important to first determine your budget and take into account any other debts or expenses you may have. From there, it’s wise to look into different financing options such as a joint loan or separate loans for each vehicle.

Some lenders may also offer discounts or special rates for financing multiple cars. It’s crucial to shop around and compare offers from different lenders to ensure you’re getting the best deal possible. Additionally, make sure to factor in other costs such as insurance, maintenance, and registration fees when budgeting for two cars.

By being proactive and thorough in your research and planning, financing two cars can be a manageable and rewarding experience.

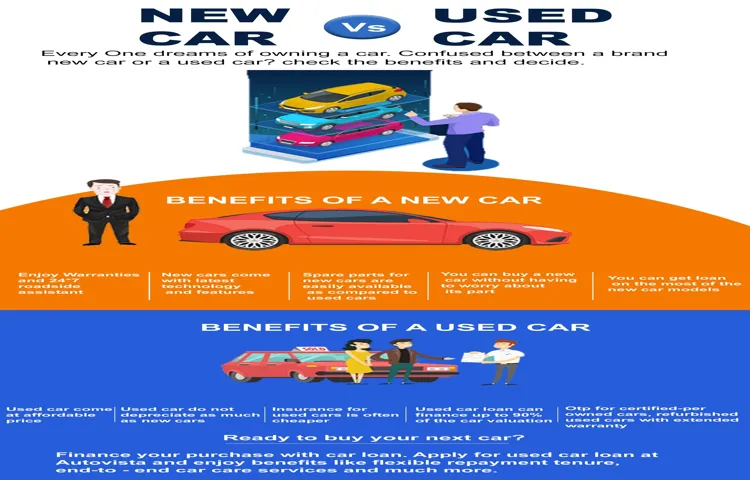

Benefits of Financing Two Cars at Once

Yes, financing two cars at once is possible and can actually bring several benefits to the table. Firstly, going for two cars instead of one can lead to better flexibility when it comes to arranging payments. Some dealerships may even offer a discount or better financing options for purchasing multiple vehicles at once.

Secondly, buying two cars simultaneously can save time and effort. Instead of having to go through the whole financing process again in the future, purchasing two cars can mean completing the process just once. Finally, financing two cars together can also streamline the insurance process and lead to lower insurance premiums as insurers often offer discounts for policies with multiple vehicles.

Overall, it can be a great idea to finance two cars at once if it suits your needs and budget.

Cost effective options

Financing two cars at once can be a cost-effective option for those who need to purchase more than one car. The benefits of financing two cars at once are numerous. Firstly, it can help individuals save money in terms of interest rates and financing fees.

Buying two cars at once allows individuals to negotiate better financing terms with lenders as they have more leverage due to the larger purchase. Additionally, financing two cars at once makes managing payments much easier since individuals only need to worry about one payment instead of multiple. This can help them avoid late payments and improve their credit score.

Furthermore, with financing two cars at once, individuals have the option to purchase different types of vehicles. For instance, they can buy a family sedan and a sports car without having to go through different lenders or loan applications. Ultimately, financing two cars at once can be a smart way to manage your finances and get the vehicles you need while saving money and time in the process.

Streamlined application process

Financing two cars at once may seem like a daunting task, but it can actually have many benefits. One of them being the streamlined application process. When you finance two cars at the same time, you only need to go through the application process once.

This means less paperwork and time spent at the dealership. Additionally, when financing two cars at once, lenders may offer special incentives or discounts, such as lower interest rates or reduced fees. This can save you money in the long run.

Just make sure to do your research and compare offers from different lenders to find the best deal. Overall, financing two cars at once can be a smart financial decision if done properly.

Opportunity for better financing terms

“financing two cars at once”Financing two cars at once can offer a world of benefits. For starters, it provides the opportunity for better financing terms that can include lower interest rates or longer repayment periods. This can result in more manageable monthly payments and potentially allowing you to afford two cars for the price of one.

Additionally, financing two cars at once can save you time and energy by streamlining the financing process into a single application and approval process. It also makes it easier to negotiate a better deal on both cars with the dealer or seller. Furthermore, buying two cars at once can allow you to diversify your transportation options or trade in one car towards the purchase of another.

Overall, financing two cars at once can provide you with greater purchasing power and more flexibility in managing your transportation needs.

Requirements

Many people often wonder, “can you finance two cars at once?” The answer is yes, you can. However, there are a few requirements you need to meet before you can finance two cars at once. Firstly, you need to have a good credit score and income that can support two car payments.

Lenders will look at your creditworthiness to determine if you’re eligible for financing. Secondly, you’ll need to provide proof of income and show that you can afford the monthly payments for both cars. Lastly, lenders may also require a down payment or collateral to secure the loan.

It’s important to carefully consider your financial situation before deciding to finance two cars at once. Make sure you have a solid plan in place to pay off both loans on time to avoid any financial troubles in the future.

Credit score

When it comes to your credit score, there are certain requirements that need to be met in order to achieve a good score. One of the most important factors is making sure that you pay your bills on time. This includes credit cards, loans, and other recurring payments like rent or utilities.

Late payments can have a serious impact on your score and can stay on your credit report for up to seven years. Another requirement is keeping your credit card balances low. High balances can make you appear risky to lenders and can hurt your score.

In addition, it’s important to maintain a healthy mix of different types of credit, such as credit cards, student loans, and car loans, as this can show that you are responsible with your finances. By meeting these requirements and staying on top of your credit, you can improve your score over time and achieve better rates and terms on loans and other forms of credit.

Proof of income

Proof of income is an essential requirement when applying for financial services such as loans or credit cards. Lenders need to verify that you have the means to repay borrowed money. They will ask for evidence of steady income, which can come from various sources such as employment, self-employment, or investments.

Typically, proof of income can be demonstrated by providing a recent pay stub, bank statement, or tax return. However, some lenders may require additional documents to establish your income, such as a signed letter from your employer, a profit and loss statement for self-employed individuals, or a documentation of rental income if you are a landlord. It is crucial to review the specific proof of income requirements for the financial product you are applying for.

By providing adequate proof of income, you not only increase your chances of being approved, but you also show your commitment to responsible borrowing.

Down payment

When it comes to purchasing a home, one of the most important factors to consider is the down payment. A down payment is a percentage of the home’s purchase price that a buyer pays upfront. The specific requirements for a down payment can vary depending on the type of mortgage and the lender.

However, in general, a down payment of at least 20% of the home’s purchase price is recommended in order to avoid having to pay private mortgage insurance (PMI). PMI can increase the cost of your monthly mortgage payment, so it’s important to try to avoid it if possible. Of course, not everyone can afford a 20% down payment, and there are options available for lower down payment percentages.

Generally, the lower the down payment, the higher the interest rate you’ll be charged. It’s important to do your research and speak with your lender in order to determine what down payment amount is right for you.

Choosing the Right Lender

Many people wonder whether they can finance two cars at once, and the answer is yes. However, it will depend on your credit score, income, and debt-to-income ratio. It’s important to choose the right lender who will offer you a reasonable interest rate and flexible repayment terms.

You can shop around and compare different lenders and their terms to find the best deal. You can also consider taking out a personal loan rather than a traditional car loan. With a personal loan, you can use the money for any purpose, including purchasing multiple cars, and you can often get a lower interest rate.

Just be sure to consider all of your options and choose a lender that meets your specific needs and financial goals.

Researching and comparing lenders

When it comes to obtaining a loan, finding the right lender is crucial. It can be overwhelming with numerous options available, each presenting different rates and repayment terms. The first step you should take when choosing the right lender is to research what is available to you.

Start by checking out lender reviews; they provide insight from past customers’ experiences. Additionally, compare the interest rates of various lenders and their terms, such as repayment periods and any penalties for late payments. Look for lenders with a good reputation for customer service, as you will be working with them for the duration of your repayment period.

Ultimately, the goal is to choose a lender that offers competitive rates and excellent terms that suit your financial needs. So take the time to do your research, and you’ll be well on your way to finding the right lender for you.

Finding the best interest rates

When it comes to finding the best interest rates for a loan, the lender you choose is just as important as the type of loan you’re applying for. Not all lenders are created equal, and some may offer better rates and terms than others. Before committing to a lender, do your research and compare rates from multiple lenders.

Look for a reputable lender with a track record of competitive rates and fair business practices. It’s also worth noting that credit unions often have lower interest rates than traditional banks, so don’t overlook them in your search. By taking the time to choose the right lender, you can save yourself hundreds or even thousands of dollars over the life of your loan.

Conclusion

Inquiring minds often wonder, can you finance two cars at once? Well, the answer is not just a simple yes or no. It all depends on your financial situation, credit score, and the lenders’ policies. But one thing is for sure, juggling multiple car payments can be a tricky feat.

It’s like spinning plates while riding a unicycle – possible to pull off but not without risks. So, before you decide to finance two cars simultaneously, make sure you weigh the pros and cons, crunch the numbers, and consider alternatives like car leasing or carpooling with friends. Remember, no matter how many cars you finance, responsible borrowing and timely payments are the keys to a smooth ride towards financial freedom.

“

FAQs

Can I finance two cars at once?

Yes, you can finance two cars at once. However, your lender may have certain requirements or restrictions, such as a higher credit score or a lower debt-to-income ratio.

What is the advantage of financing two cars at once?

Financing two cars at once can help you get a better interest rate or lower monthly payments, as some lenders may offer discounts or incentives for multiple car loans.

What is the disadvantage of financing two cars at once?

The disadvantage of financing two cars at once is that it can increase your debt and financial obligations, making it harder to manage your budget and stay on top of your payments.

Can I get approved for financing two cars at once with bad credit?

It may be more difficult to get approved for financing two cars at once with bad credit, but it’s not impossible. You may need to provide a larger down payment or find a co-signer to increase your chances of approval.

What is the maximum number of cars I can finance at once?

The number of cars you can finance at once may depend on your lender’s policies and your financial situation. Generally, it’s advisable to avoid taking on more debt than you can comfortably handle.

Do I need to purchase both cars from the same dealer to finance them together?

No, you don’t necessarily need to purchase both cars from the same dealer to finance them together. However, it may be more convenient to do so and may give you more bargaining power.

How can I find the best deal on financing two cars at once?

To find the best deal on financing two cars at once, you should compare offers from multiple lenders, negotiate the terms and interest rates, and consider any incentives or discounts available.